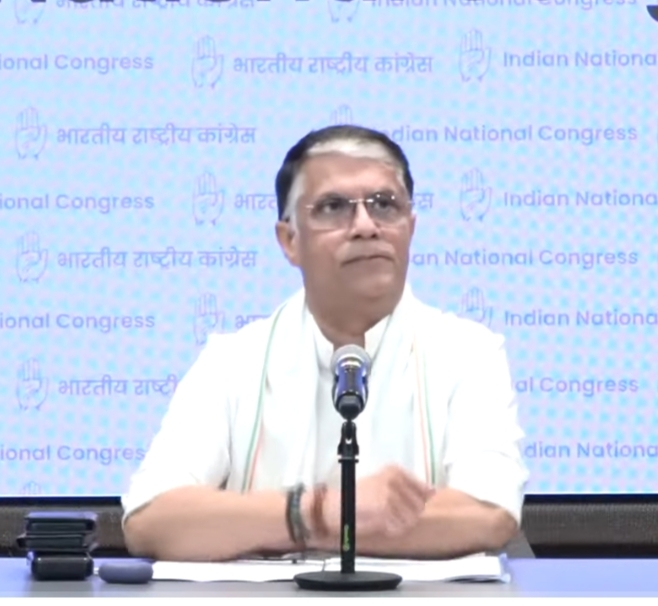

PAWAN KHERA SLAMS BJP OVER ETHANOL FUEL POLICY

NEW DELHI: Congress leader Pawan Khera on Thursday slammed the BJP at a press conference at the AICC headquarters here over the ethanol policy and delayed GST reforms.

He criticised the Modi government’s delayed GST reforms after eight years, claiming they are finally following Rahul Gandhi’s long-standing advice. Gandhi had demanded a re-evaluation of GST’s impact on the poor and businesses alike.

Khera’s comments came a day after Finance Minister Nirmala Sitharaman announced a major cut in Goods and Services Tax (GST) rates on essential goods, cars, farm equipment, and electronics.

The GST rate cut move is being seen as a major reform aimed at providing relief to households, businesses, and the healthcare sector. The GST Council has simplified tax rates by limiting them to 5 per cent and 18 per cent, effective 22 September.

Rahul Gandhi advocated a 18% cap on the GST rate in everybody’s interest. He said as an indirect tax GST affects both rich and poor alike, He would urge the rate at 18% or lower so that the poor are not unduly burdened. Since 2005, he said the Congress wanted a GST that is not only pro industry and pro trade, but also not inflationary for the common people, especially the poor.

In a post on X, Pawan Khera wrote, “When they finally have to follow RahulGandhi’s advice, why do they take so much time in doing that?”

The leader of the Opposition in Lok Sabha, Rahul Gandhi had earlier urged for an 18 per cent GST cap and has often dubbed the GST the Gabbar Singh Tax.

“For the last 18 months the Indian National Congress has been demanding fundamental changes into the Goods and Services Tax 2.0,” Congress MP Jairam Ramesh said in a statement.

Senior Congress leader P Chidambaram welcomed the Centre’s recent GST rationalisation and rate cuts but criticised the move as being “8 years too late”.

In a post on X, Chidambaram, the former Union Finance Minister, said the current GST design and rates should not have been introduced in the first place, adding that the opposition had repeatedly warned against these issues for years, but their pleas were ignored.

In a post on X, Chidambaram, the former Union Finance Minister, said the current GST design and rates should not have been introduced in the first place, adding that the opposition had repeatedly warned against these issues for years, but their pleas were ignored.

The 56th GST council meeting decided to rationalise GST rates to two slabs of 5 per cent and 18 per cent by merging the 12 per cent and 28 per cent rates.

While the 18% slab consists of a standard rate for most goods and services, including automobiles such as small cars and motorcycles (up to 350cc), consumer goods like electronic items, household goods, and some professional services, a uniform 18% rate applies to all auto parts.

WHY 9 TAXES?

Congress leader Priyank Kharge on Thursday slammed the Centre’s recent GST reforms, saying the concept of “One Nation, One Tax” has effectively become “One Nation, 9 Taxes.”

GST symbolic pictured used